to Generate Personalized & Dynamic Debt Collection Journeys

Unlock improved recovery rates & achieve cost savings in weeks not months

Professional services with collections and Behavioral Science expertise

AI accelerates iteration for unprecedented levels of optimization

Empower your customers to strengthen trust and loyalty

Symend can ingest from any source, from a simple flat file to integrated real-time APIs — normalizing your data to fuel predictive signals & AI.

Symend Scores use AI to quantify a customer’s likelihood to repay, relapse, or respond — tracking +100 real-time behavioral and engagement signals to dynamically adjust & maximize results.

Symend assigns behavioral science-based psychological archetypes for optimal segmentation, ensuring the right message is sent the right way, at the right time — drastically improving engagement rates and customer experience.

GET STARTED WITH A FREE ROI REPORT

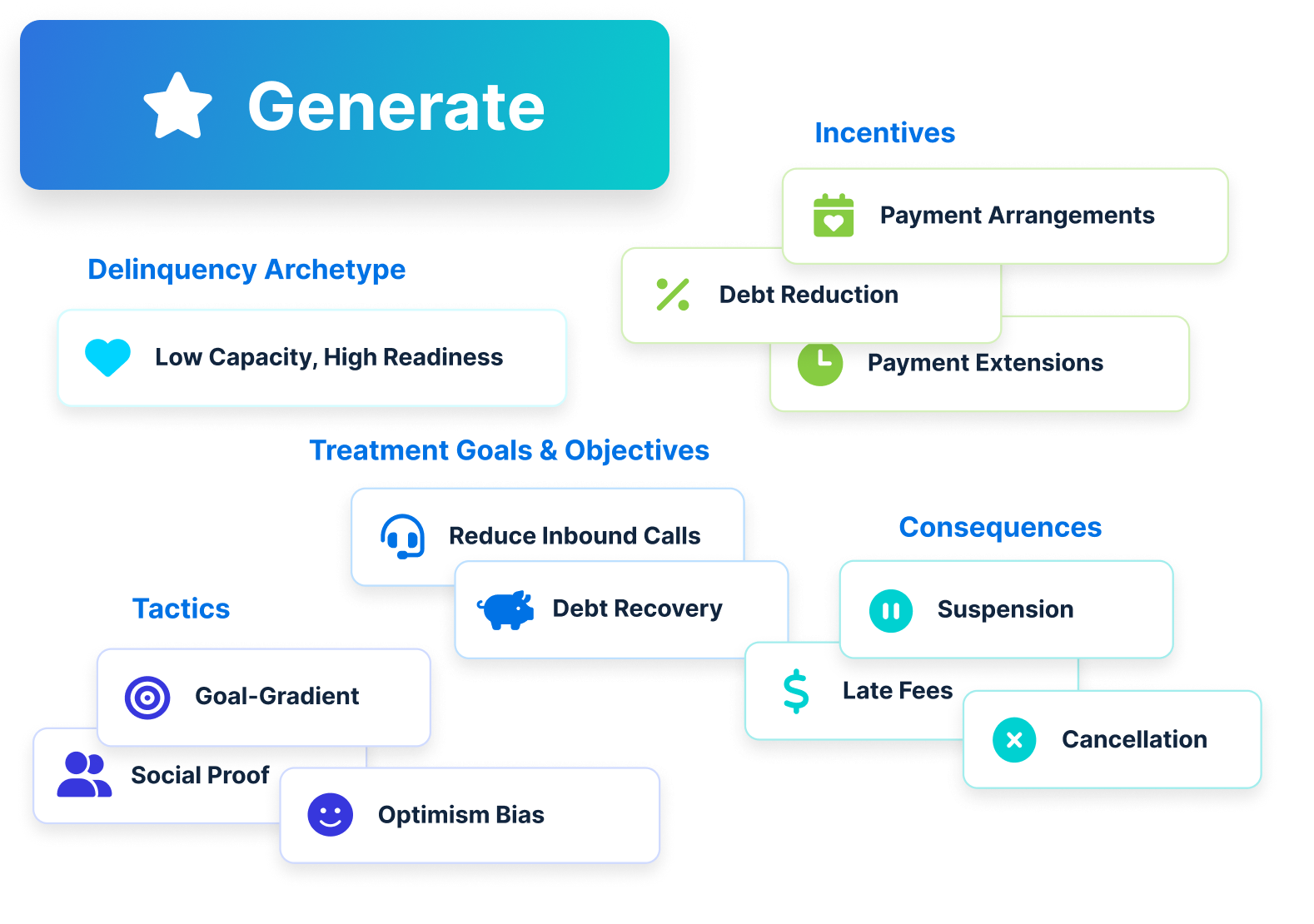

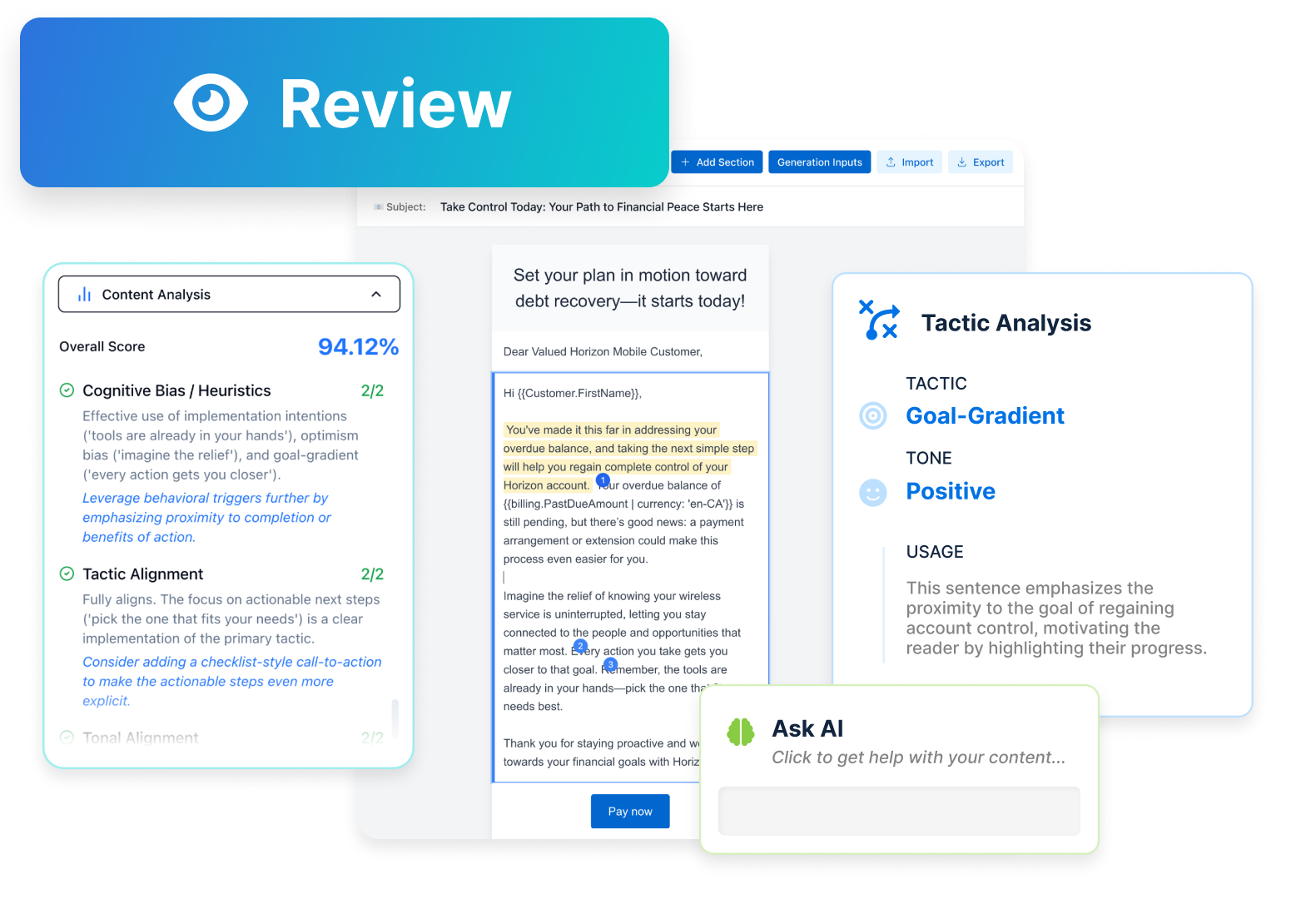

Symend generates hyper-personalized engagement with embedded behavioral science tactics proven to work best with your customer’s profile — dynamically optimizing based on real-time signals to maximize results.

Generate hundreds of engagements in minutes matching specific customer segments, tactics, and business objectives.

Symend integrates real-time learnings into every stage of active journeys, delivering compounding performance over time.

GET STARTED WITH A FREE ROI REPORT

Score &

Segment Based on Predicted Behavior

Real-Time

Re-Scoring &

Re-Segmentation

Optimize

Engagement at

the Message Level

Iterate & Converge

at the Journey

Level

+10%

Increase in Recovery Rates

-50%

Reduction in OpEx Costs

10x

Proven ROI With Symend

Symend is proven to deliver over 10x ROI. Get your custom report on how we can improve cure rates, LTV & reduce OpEx costs for your unique business today.

GET YOUR FREE CUSTOM REPORT

Unpack some of our most commonly asked questions. Don’t see what you’re looking for? Speak to our team today.

Symend is a next-gen engagement platform transforming enterprise collections with the power of AI and Behavioral Science. Symend predicts a customer's behavior based on Delinquency Archetypes and generates AI-optimized, hyper-personalized engagement journeys that break through the noise. With over 9 years of experience treating over 250 million delinquencies and over $50 billion in recoveries, Symend delivers up to 10% higher recovery rates, 50% reduction in OpEx costs and 10x ROI while strengthening customer relationships for enterprise telecommunications, financial services, and utilities companies.

Symend requires a minimum of just 12 fields to start, scaling from simple flat files to multiple data inputs and real-time APIs with minimal IT resources. The platform combines primary customer data with secondary behavioral data, using AI and machine learning to optimize messaging effectiveness and timing. Both data sources feed into customer scoring, while built-in compliance safeguards ensure all communications meet regulatory standards like GDPR and CCPA. Symend is SOC 2 and ISO certified.

Delinquency Archetypes are customer segments based on behavior, not just financial history like credit scores or risk bands. They combine two factors: Capacity to Pay (financial means) and Readiness to Act (motivation to resolve). This framework maps customers into archetypes that guide treatment strategies. Symend's approach has been validated in market, with delinquency archetypes proven to improve engagement and reduce customer churn by up to 21%.

Yes, Symend integrates seamlessly with existing collections systems and standard operating procedures. Symend can seamlessly ingest existing data sources such as CRMs, risk scoring, dialler files, and core banking systems through robust APIs and pre-built connectors. Symend offers full orchestration and execution of email, text, IVR and letter delivery through its platform or leverage the client's in-house tools.

Symend offers full orchestration and execution of email, text, IVR and letter delivery through the platform or leverage a client's in-house tools, providing a multi-channel approach that allows for personalized outreach based on customer preferences. This omni-channel strategy maximizes engagement and recovery rates.

Symend is SOC 2 compliant and ISO certified with built-in safeguard functionality. The platform prioritizes ethical AI use through transparency, fairness, and privacy, employing strict data protection protocols including data minimization and encryption. Symend ensures compliance with GDPR and CCPA regulations while regularly auditing AI models to prevent bias, exclusively using behavioral data rather than demographic information for decision-making.

Symend Scores are proprietary predictive measures that identify patterns in customer behavior over time. By analyzing recurring records and trends, they forecast outcomes such as the speed of debt recovery or completing a payment plan. Symend scores have a predictive accuracy exceeding 90%. These scores transform traditional risk models into personalized Delinquency Archetypes, enabling organizations to anticipate outcomes, tailor engagement strategies, and improve recovery results.

Engagement Journeys are fluid, personalized experiences—not static scripts—that Symend designs and executes using AI and insights from behavioral science playbooks. These AI-optimized journeys create dynamic series of interactions across email, text, and digital channels that continuously adapt to customer preferences and behaviors. Real-time customer evaluations constantly optimize these journeys, dynamically adjusting tone, timing, and touchpoints to deliver the right message to the right person at the right time.

Customer feedback drives Symend's real-time optimization of customer evaluations to dynamically adjust unique journeys and maximize results. The platform's AI continuously learns from engagement patterns and client feedback to refine messaging, timing, and personalization. Symend empowers customers to self-cure through payment options like autopay and payment arrangements, nurturing each customer based on their unique engagement patterns, increasing recovery rates up to 10%.

Symend continuously optimizes at four levels for unmatched sophistication: scoring and segmenting based on predicted behavior, real-time re-scoring and re-segmentation throughout journeys, optimizing engagement at the individual message level, and iterating at the journey level to converge on highest-converting strategies. This dynamic approach ensures strategies adapt in real-time to customer behavior changes and market conditions for maximum effectiveness.

No, training is not required. Symend is designed for low IT lift and comes with support from a dedicated team of professionals, including collections experts, data analysts, and behavioral science specialists. From day one, Symend ensures a smooth implementation and integration so organizations can quickly realize value.